As Netflix swoops on Warner Bros in a record breaking takeover, British crews, studios and filmmakers are asking the same question: is this the start of a golden age for UK production, or the beginning of dangerous over consolidation?

London, 5 December 2025

Netflix has agreed to acquire Warner Bros Discovery’s film, television and streaming businesses in a cash and stock deal that values the studio at about 72 billion dollars in equity and roughly 82.7 billion dollars in enterprise value, with a price of 27.75 dollars per share for Warner Bros Discovery investors. Competing offers from Paramount, Skydance and Comcast were beaten in a frantic bidding war, giving Netflix control of franchises such as Harry Potter, DC, Game of Thrones and the entire HBO operation, while Warner’s linear channels including CNN and Discovery brands are being spun out into a separate company called Discovery Global.

In Hollywood this is being called a once in a generation deal. In the UK, where Warner and Netflix already spend heavily on production and studio facilities, the consequences may be felt even more sharply.

Below is what UK filmmakers, crews and production companies need to know now.

Under the agreement announced on 5 December, Netflix is set to acquire:

Excluded from the deal are:

These will sit in a separate business, Discovery Global, once the spin off completes, currently expected in 2026.

Regulators in the United States, the European Union and the United Kingdom still need to approve the deal, which could take twelve to eighteen months and may involve conditions.

For now, however, the direction of travel is clear. Netflix is no longer just the world’s largest streaming platform. It is about to become the owner of one of the most important studio groups on earth.

Britain has quietly become one of the world’s production superpowers. Film and high end television spend in the UK reached more than 5.6 billion pounds recently, driven largely by inward investment from studios such as Warner Bros, Disney, Netflix, Amazon and Apple.

Warner Bros has long been embedded in the British ecosystem. It owns Warner Bros Studios Leavesden in Hertfordshire, home to the Harry Potter films, Fantastic Beasts and a long list of US and UK productions, following a 100 million pound investment and acquisition in 2010.

Netflix, meanwhile, has become one of the most active commissioners of UK scripted series and films and already leases significant stage space across the country.

Put those two together and you get:

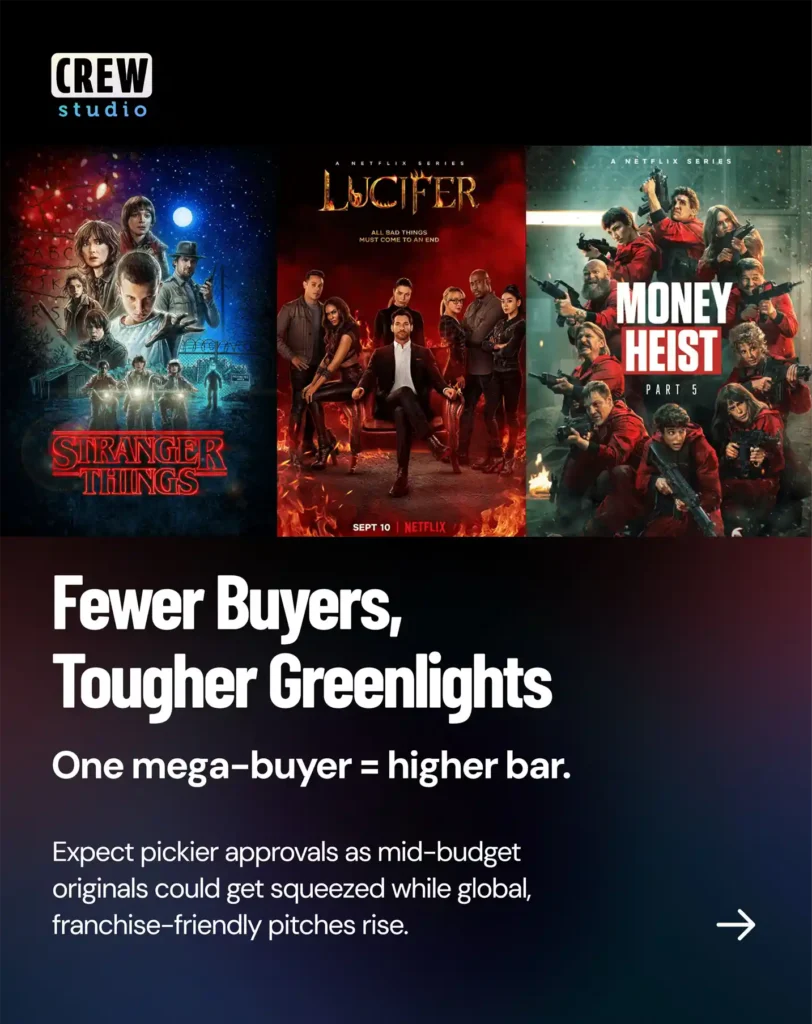

For UK filmmakers this could mean larger budgets and more ambitious projects. It could also mean fewer buyers with more leverage.

Netflix is buying Warner not to shrink output but to feed a global audience and keep subscribers and advertisers hooked. Analysts point to planned cost synergies of 2 to 3 billion dollars a year, but much of that is expected to come from back office consolidation, marketing and overlapping technology rather than a wholesale retreat from production.

The UK remains one of the easiest places in the world to shoot:

It is difficult to imagine Netflix walking away from that. If anything, having direct control of Leavesden and the broader Warner infrastructure could lock even more production into the UK for flagship titles such as Harry Potter, DC features and HBO style fantasy shows.

For UK crews and HoDs this may translate into:

For writers, directors and producers, the idea of being able to take a project to one entity that controls both the streaming outlet and a major studio machine could be attractive.

In theory, a project that might once have bounced between HBO, Warner Bros Pictures, Sky Atlantic and Netflix now has a more straightforward path. If the combined company integrates its commissioning structures sensibly, you could see:

In other words, if you are developing a grounded British crime drama or fantastical YA series and want a single global patron with pockets deep enough to build out a franchise, Netflix plus Warner is hard to ignore.

The merger lands at a time when UK politicians and regulators are already scrutinising the role of streamers and talking openly about levies or obligations tied to UK production. MPs have floated ideas such as a levy on Netflix and other services to support British drama and protect distinctive UK stories.

With such a large deal on the table, it becomes politically easier for the government to insist on:

If regulators make those commitments a condition of approval, UK film and television could benefit from a more secure, long term investment pipeline.

The optimism sits alongside real anxiety, particularly in Europe.

On both sides of the Atlantic, producers and politicians worry that combining Netflix and Warner will concentrate too much power over commissioning, pricing and rights. A coalition of film producers has already urged US lawmakers to block the deal, warning of an economic and institutional crisis if it proceeds unchecked.

For UK independents, the concern is straightforward:

These worries sit on top of a longer running fear that the rise of streamers could weaken the financing model for UK independent films, which has already been under strain.

Warner Bros has historically been one of the pillars of UK cinema: big DC superhero titles, prestige awards films and crowd pleasers such as the Harry Potter series are vital to box office and concession revenues.

Netflix, by contrast, has treated theatrical release largely as a marketing and awards play, typically with short cinema windows before films revert quickly to streaming. European exhibitors have long complained about that approach.

The main European cinema body, UNIC, which represents operators across 39 countries with about 43,500 screens, has already denounced the Netflix Warner deal, warning that it fails basic tests of protecting diversity, access and cinema viability and predicting significant cinema closures if it is approved unchanged.

If Netflix were to push more Warner titles straight to streaming, or radically shorten UK theatrical windows, independent and regional cinemas could suffer.

If, however, regulators force the combined company to honour robust theatrical commitments for major titles, Netflix might evolve into something closer to a traditional studio in its treatment of cinemas. For filmmakers who love the big screen, this is one of the most important questions in the entire deal.

UK MPs have already expressed concern that streaming consolidation could erode distinctly British stories and voices.

A merged Netflix Warner will command huge influence over what kinds of British narratives travel globally. The risk is that:

For working filmmakers, the danger is not a total lack of work but a narrowing of the kinds of work that get meaningful support.

The UK Competition and Markets Authority is almost certain to examine the deal. UK lawmakers were already raising concerns about streaming consolidation even before Netflix emerged as the winning bidder, asking the government how it would respond to further concentration in the sector.

Possible UK conditions could include:

How tough the CMA chooses to be will set the tone not only for this merger, but for the next decade of media consolidation in Britain.

This is a corporate mega deal, but the questions on set and in writers rooms will be very human. Does this help my career, or hurt it?

If you are currently in conversation with Netflix or Warner’s UK teams, keep those talks moving. A strong package with solid talent and finance is still attractive.

Once the dust settles, expect:

For you, this suggests three parallel strategies:

As the deal progresses, there are a few signposts UK filmmakers should monitor closely:

Netflix’s takeover of Warner Bros is not just another media deal. It is the moment the world’s dominant streamer becomes a fully fledged studio owner with deep roots on British soil.

For the UK film industry, that could lock in a decade of high volume, high budget work, anchored around Leavesden, British crews and a powerful pipeline of franchises. It could also reduce competition, squeeze independent producers and hasten a shift away from cinemas if regulators and policymakers do not hold their nerve.

If you are a filmmaker in Britain, the practical message is clear:

Join The Crew. We’ll only send you exciting emails.